2020 Non Variable Hour Employee Benefits Options

For Non Variable Hour Long Term Consultants (assignment length expected to be longer than one year at time of hire), & Corporate staff, iTech has contracted two insurance providers: Harvard Pilgrim Health Care (HPHC) and Compass Benefits Solutions. HPHC offers three standard coverage plans; two High Deductible HSA eligible Plans (HDHPs) and one PPO. Compass provides employees the opportunity to purchase Minimum Essential Coverage (MEC) at two separate levels MEC & MEC+.

Although is not required if you enroll in an HDHP it is recommend to open a Health Savings Account (HSA) and begin contributions, your contributions will also be tax free and work in tandem with your insurance policy. To learn about opening an HSA and begin contributing through payroll deductions visit the iTech HSA Info Page.

For 2019 we have partnered with PPI Benefit Solutions, you will have access to the Self Service Portal where you can select the plans as well as wive the benefits you decide not to participate in. Employees will need to access the portal and either enroll in one of the offered plans or waive benefits no later than 1st of the month following 30 days of employment.

To enroll in benefits register at www.ppienroll.com

View the PPI Employee Registration instructions.

Health Options

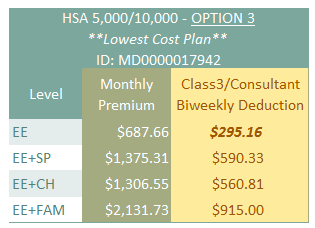

HDHP $5,000/$10,000 HSA Eligible – Lowest Cost Plan*

*If the lowest cost plan single only coverage is over 9.86% of your monthly gross income you will be eligible for a subsidy from iTech for the difference in cost.

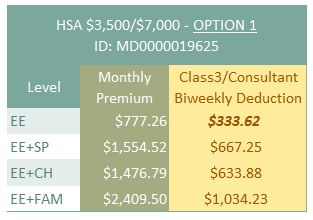

HDHP $3,500/$7,000 HSA Eligible

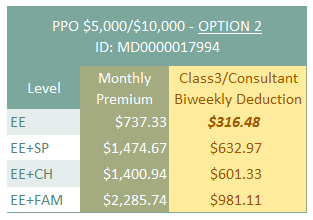

PPO $5,000/$10,000

Dental Options

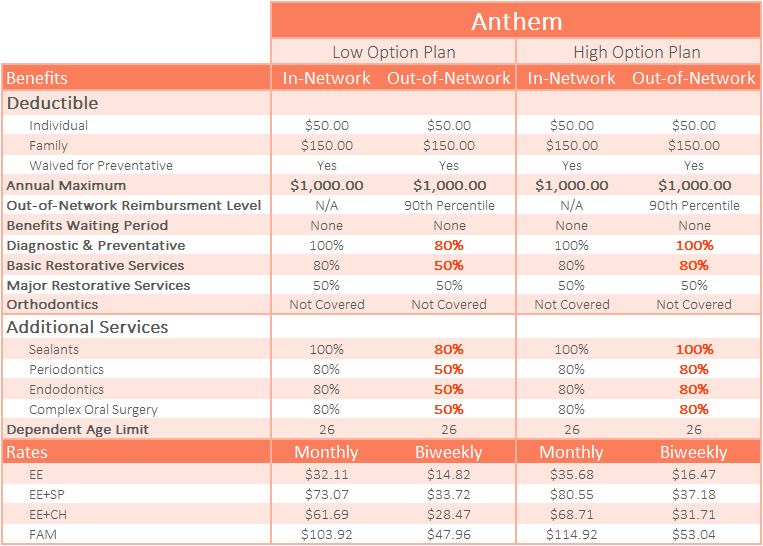

Dental coverage is offered by Anthem; you have two options to select from. Both plans offer the same benefits as long as you stay in the network. Preventative is covered at 100% from day one, basic services are covered at 80% and major services are covered at 50%, with a calendar year maximum of $1,000.

Dental High Option Plan covers the same amount benefit whether your dentist is in or out of network, while the Dental Low Option Plan covers a lower percentage. Please view the plan summaries for exact coverage.

Dental High Option

Dental Low Option

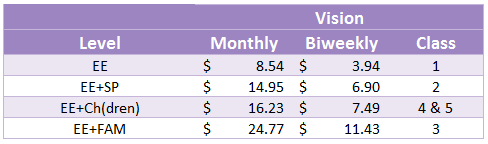

Vision Plan

Full vision coverage, including contacts and glasses, is available from Anthem as a standalone policy.

- Anthem BlueVision Plan Summary

- Anthem BlueVision Certificate – Full plan description

Group Short Term Disability

A short term disability policy provides you with income protection. It replaces a portion your income when you have a qualifying disability due to a covered accident or illness that prevents you from earning a paycheck.

- Short Term Disability – Anthem Product* – All newly hired employees will be automatically enrolled in the Short Term Disability Plan (60% base maximum weekly benefit $1,500) unless they opt out. Please remember as a new hire you will not need to go through underwriting for this benefit, should you need to enroll at a later time you will be required to complete an evidence of insurability document.

Rates:

Ancillary Benefits

These completely voluntary benefit offers are available through Aflac, if you are interested in these plans please reach Aflac directly at 860-989-3050, to discuss. Please remember iTech only facilitates payments we do not administer the benefits.

- Critical Illness Insurance – Aflac Product

- Accident Insurance – Aflac Product

- Hospital Indemnity – Aflac Product

If you have any questions feel free to reach the Human Resources Department at HR@itechsolutions.com.