Healthcare Spending Accounts

Health Savings Accounts (HSAs) were created in 2003 so that individuals covered by high-deductible health plans could receive tax-preferred treatment of money saved for medical expenses. Generally, an adult who is covered by a high-deductible health plan (and has no other first-dollar coverage) may establish an HSA.

Because the concept of an HSA may be new to many folks out there we have compiled a small list of educational and informational links that may help to demystify what HSAs are all about. Our third party HSA administrator is always ready to assist you in your benefit selection as well as to advise you on how to best utilize and invest your HSA assets. To request a free HSA Consult from a competent HSA Advisor please click the “Request HSA Consult” button below.

- All About HSAs IRS Publication 969

- IRS 2019 HSA Adjusted Amounts

- U.S. Treasury Health Savings Accounts Resouce Center

- What is a Health Savings Account HSA

Filing for your HSA

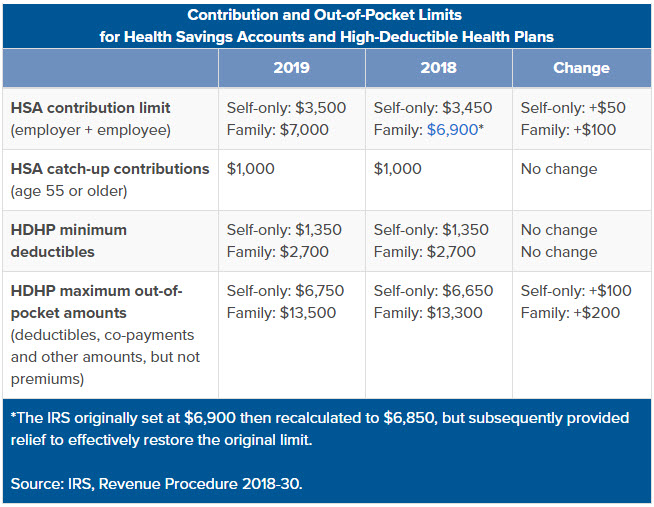

Limits for Contributions and Out-of-Pocket Expenses

| Return Instructions: All forms should be completed and returned via fax or scanned and e-mailed immediately. Originals should then be mailed to our Human Resources Department using the address below. If you are e-mailing completed forms back, please use the generic iTech Solutions’ HR email address below. |

|

iTech Solutions, Inc. |